Top Five Smartphone Brands in India as of Q3 2021

Based on IDC's Worldwide Quarterly Mobile Phone Tracker data gathered

in Q3 2021, India's smartphone market registered a year-over-year

decline of 12% from June to September 2021 with 48 million units shipped

after four consecutive quarters of growth.

The said decline can be attributed to component shortage and to an unusually

high Q3 2020 comparison base. Interestingly, compared to Q3 2019, 3Q21

actually grew by 3% as channels stocked up for the Diwali quarter in the

face of the supply shortages.

To quote Mr. Navkendar Singh, Research Director, Client Devices

& IPDS, IDC India. "The first nine months of the year already shipped

120 million units, with H1 2021 clocking 42% YoY growth. Due to supply

challenges, Q4 2021 is expected to see a decline, resulting in annual

shipments below 160 million in 2021."

He added, "The first half of 2022 will remain challenging, with some

easing out expected in the latter half of 2022. Vendors/channels will keep

an eye on the over-stocking situation in case demand stays limited due to

the price hikes by the suppliers and vendors."

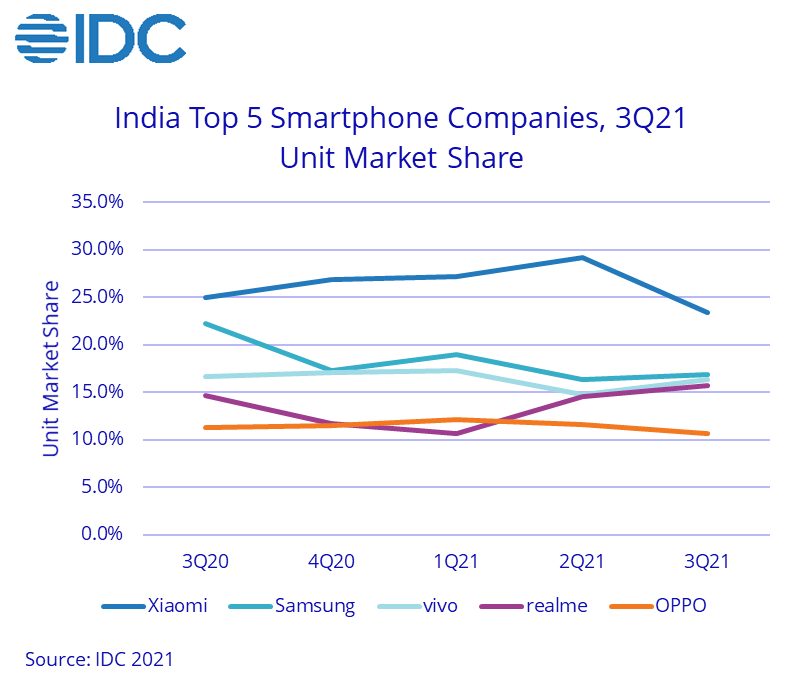

Top 5 Smartphone Brands in India as of Third Quarter of 2021

Based on data gathered by IDC, the leading smartphone brands in India in

terms of total units shipped as of Q3 2021 are Xiaomi, Samsung, vivo,

realme, and OPPO, respectively.

Xiaomi remained at #1 despite a 17% year-on-year shipment decline.

Poco, Xiaomi's sub-brand exclusive to online stores, saw a high 65% YoY

growth. Amazingly, 72% of Xiaomi's shipments were concentrated in online

shopping sites, with its market share at 32%. Xiaomi Redmi 9A/9

Power/9/Note10s were the major volume drivers for the Chinese brand along

with the best-selling Poco M3 and Poco C3.

At #2, Samsung registered the highest YoY decline amongst the top 5

vendors at -33% in the third quarter of 2021. With focus on the Samsung

Galaxy M and F midrange series, 49% of the Korean Giant's shipments were

sold online, allowing the vendor to take 16% share. However, entry-level

models like the Galaxy A22/A12, which were mainly sold offline, accounted

for 23% of Samsung's overall shipments. The opening quarter for the Samsung

Galaxy Z Fold3 and Z Flip3 flagship models witnessed a demand surge but

their sales suffered due to supply constraints. Despite all that, Samsung

still managed to get the top position within the 5G segment with its new

releases.

vivo was at #3 with an annual shipment decline of 13% coming from

2020. Nevertheless, the brand continued to cement its offline presence with

a 30% share. Additionally, vivo strengthened its portfolio in the US$200-300

price segment with its V and iQOO entry-level series as well as its

effective marketing campaigns for the vivo X series.

#4 realme had the best performance of the top 5 brands in terms of year-on-year shipment with just a 5% decline. Amazingly, realme is the second best-selling

smartphone vendor in online stores with a high 22% share. The realme C11

2021 as well as the realme 8 4G and 5G models were the brand's top sellers

in Q3 2021.

The #5 brand in this list is OPPO, which saw a 16% YoY decline in shipments

in third quarter of 2021. Nonetheless, in the US$300-500 price bracket, OPPO

landed in the second slot with an 18% share, which was driven by high

shipments for the OPPO Reno 6 series.

Post a Comment